The worst job report for a number of years in the US led to a slump in all the major US indices on Friday. According to the report 63,000 jobs were taken away in March. Of course, since the US markets tumbled on Friday, most of the Asian markets (with the exception of Hong Kong) went down today.

The Malaysian Market led them down dropping more than 9%. Australia was down 1.74%, Shanghai down 3.59%, Jakarta down 4.73%, the Nikkei down 1.96% the Straits times down 1.02% and the Seoul Composite down 2.33%. Taipei’s index was down 2.72% at the close.

The Malaysian Market led them down dropping more than 9%. Australia was down 1.74%, Shanghai down 3.59%, Jakarta down 4.73%, the Nikkei down 1.96% the Straits times down 1.02% and the Seoul Composite down 2.33%. Taipei’s index was down 2.72% at the close.

(Asian Market Indices for March 10, 2008, Source: Yahoo Finance)

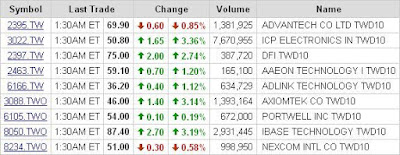

Despite these dramatic declines, the share prices for most industrial PC (IPC) companies listed on either the Taiwan Market or Over the Counter Market went up. The only one to go down (and only by 0.85%) was Advantech. ICP Electronics rose by 3.36%, DFI by 2.74%, Axiomtek by 3.14% and IBASE by 3.19%.

(Industrial PC Company Share Prices in Taiwan, March 10 2008)

These rising share prices may indicate the nature of this market. Most of their clients (system integrators and system developers) plan their projects on a one to three year time scale. The IPC companies are therefore assured of revenue streams in the future and are less exposed to short-term fluctuations in the economies.

I have no doubt that if the indicators remain bad the system integrators and developers will need to cut back on their expenditure. This would then lead to declining share prices for the IPC companies.

I have no doubt that if the indicators remain bad the system integrators and developers will need to cut back on their expenditure. This would then lead to declining share prices for the IPC companies.

Here’s to hoping they carry on rising tomorrow!

No comments:

Post a Comment